It’s been clear for quite some time from industry data and personal experience that net organic revenue growth of RIA firms is quite low when you, by definition, exclude market movement.

Charles Schwab released their 2022 RIA Benchmarking Study and I decided to crunch the numbers and see what the data shows.

I’ll go straight to the punch line —> The average RIA firm had negative revenue growth over the past five years if you exclude market movement using a traditional 60/40 market portfolio as a proxy for RIA investment allocations.

In other words, essentially all the revenue growth for RIA firms in the Schwab study over the past five years was simply due to growth in the financial markets.

Various assumptions are built into my calculations but there’s no doubt net organic revenue growth is almost non-existent.

Why care? Organic growth is the lifeblood of a business and without it, you are at the mercy of volatile financial markets.

Special Podcast on Lack of Organic Growth

In this episode, you’ll hear my interview on the Perfectly Integrated Podcast hosted by Matt Ackermann, the Chief Content Officer at Integrated Partners. I share:

- The real growth rate of the typical advisory firm.

- Why you have to grow about 5% – 7% per year just to net 0% growth.

- The reasons behind this lack of growth.

- What advisors can do to get back on a growth track.

- Why these reports you see about firms growing 30% to 50% per year are often quite misleading.

- How firms in the $500M to $1B AUM range are NOT at a disadvantage and are NOT in the “messy middle” of too big for lifestyle and too small for enterprise size economies of scale.

Crunch the Numbers

Here’s how I crunched the data.

The S&P 500 total return for the 5 years ending December 2021 was 112.9%. The total US Government Bond market total return for the 5 years ending December 2021 was 19.5%. With a traditional 60/40 allocation, this portfolio would have grown about 75.5% over the past 5 years for a CAGR of about 11.9%.

Now, let’s take two cuts at the growth performance of advisory firms in the 2022 RIA Benchmarking Study from Charles Schwab relative to what the markets did.

AUM Growth

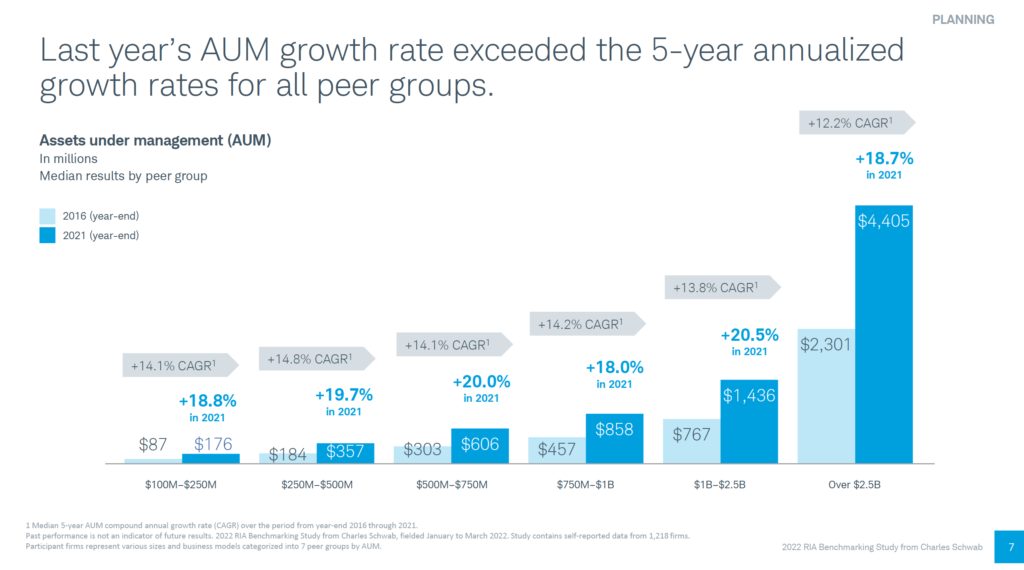

Schwab’s Benchmarking Study breaks out its results in 6 peer groups based on AUM as you can see in the chart below.

Schwab’s report says the average CAGR of AUM for all firms in the study for the 5 years ending 2021 was 14.1% (and, interestingly, the slowest growing firms were the largest, the ones with >$2.5B in AUM). The 14.1% CAGR of AUM sounds pretty good until you look at how much of that growth was simply due to market growth.

For comparison, a passive 60/40 bond portfolio, as mentioned above, grew at a CAGR of 11.9%.

Simple math says the CAGR of NET NEW ASSETS (i.e., excluding market movement) for the average RIA firm that custodies at Schwab was only 2.2% over the past 5 years.

Revenue Growth

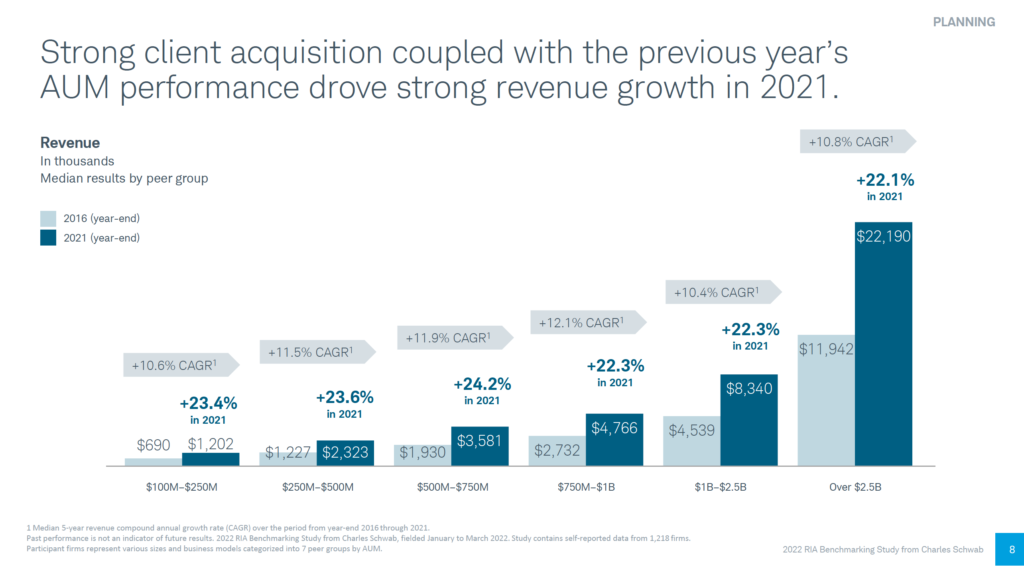

You can’t eat AUM so let’s look at actual revenue.

Schwab’s report says the average CAGR of REVENUE for all firms in the study for the 5 years ending 2021 was 11.3% (and, interestingly, the fastest growing firms were the $750M to $1B AUM firms–the ones that many industry pundits say are in the “messy middle” where they’re too big to be lifestyle and too small to benefit from economies of scale).

So, here’s the deal…

A passive 60/40 bond portfolio, as mentioned above, grew at a CAGR of 11.9%. This suggests that the average RIA firm actually had NET NEGATIVE ORGANIC REVENUE GROWTH over the past five years, and the only reason why they showed positive revenue growth was due to market movement.

3 Observations

Having worked in this industry for 30 years and coached advisors for more than 20 years, I will say that I am NOT surprised by this data. Here’s what my experience tells me.

- The typical advisor works really hard for their first 10 years in the business. If they survive, they start making several hundred thousand dollars a year in personal income and they’re happy. At that point, they focus on maintaining the business and the business grows through a few referrals (who replace distributions and lost clients) and rising markets over time. And let me be clear, there’s nothing wrong with this scenario.

- There’s a small number of advisors who are not satisfied with a one- to-three-million-dollar revenue practice and want to build an eight or nine-figure revenue business. We all know who those names are. The funny thing is, many of those firms show substantial AUM and revenue growth, but the vast majority comes from M&A growth, not net organic growth.

- If you want to increase the long-term value of your firm and not just focus on sustaining your current income, then double down on organic growth. Very few advisory firms deliver consistent, repeatable organic growth. And many of those that do rely on referrals from custodians—which results in concentration risk.

The most valuable firms are those that demonstrate consistent net organic revenue growth. Last year, my coaching clients who had been with me for the full year grew revenue an average of 45%, and none of that came from M&A.

If you’d like to explore how I can help you in your business and growth strategy, take a look at my coaching page.