RIA owners often tell me how frustrated they are that the associate advisors at their firms avoid business development work and seem to plateau.

Despite giving their associate advisors opportunities, leads, referral strategies, and help crafting business development plans, they rarely see big results from all that motivating, inspiring, and yes, cajoling.

In many cases, the reason why those associate advisers are not aggressively pursuing new business is because they have already reached a plateau at their level of personal and professional comfort.

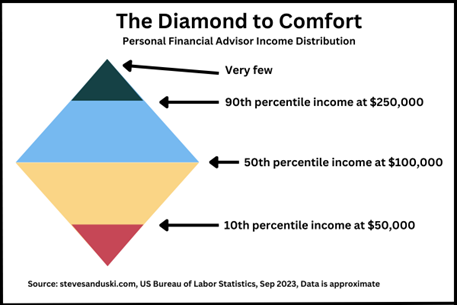

The Diamond to Comfort

I want you to picture Maslow’s Hierarchy of Needs. But instead of it being a path to self-actualization, think of it as The Diamond to Comfort.

According to the Bureau of Labor Statistics:

- The lowest earning 10% of advisors max out at about $50,000 of income.

- The next 40% of advisors top out at about $100,000 (which is the median pay for all personal financial advisors).

- The next 40% of advisors top out at about $250,000.

- The top 10% of advisors earn a minimum of about $250,000 in personal income.

For comparison, the median household income across the US is about $75,000, so the median advisor earns about 33% more than the median household.

Once an advisor hits that $100,000 median level of income and attains a base level of comfort, you will find that fewer of them will do the work that is necessary to keep moving up the diamond. Instead, they shift to “maintenance mode” instead of “growth mode” and let rising markets over time give them a pay raise.

By the time an advisor hits $250,000 of income, they’re in the top 10% of all advisors, life is probably pretty good, and for many, the impetus to want to keep “crushing it” has been exhausted.

Said another way:

- When we start in the business, we all work extremely hard because we have to put food on the table. We’ll do everything we can to make sure that we make a base level of income that meets our basic needs—similar to the first two rungs on Maslow’s hierarchy. Let’s call that the 50th percentile of income or about $100,000.

- Once we have our base needs covered then we can take a deep breath, perhaps slow down a bit, but we will continue to work reasonably hard because now we’re starting to enjoy some of the finer things in life. We buy a nicer house, take fancier international vacations, buy the boat, and get invited to be a podcast guest. And if we have a spouse who works, that double income will put us into multiple six figures of family income. At this level, many advisors will tell themselves that they are making way more money than they ever expected so now they switch to business maintenance and life enjoyment mode.

Who Keeps Working Hard?

The advisors who will keep working hard to reach that top 10% level, are, by definition, rare.

It begs the question, “Why do we see some people continue to work extremely hard long past the point where they have plenty of money to be comfortable?”

While there is no single reason, one of the most common answers is that they are driven by something that happened in their early years of upbringing. This gets into the psychological area of scarcity, security, having something to prove, a chip on their shoulder, humiliation, overbearing parents, ego, and so on.

This article is not designed to explore the psychology of that small percentage of advisors for whom there is never enough.

Rather, it’s to shed light on why advisors plateau and turn to maintenance mode once they reach their level of comfort, and to point out that there’s really no amount of motivation, inspiration, or incentive that is going to take someone who is psychologically healthy, that has reached their level of comfort, to get them to all of a sudden start working a lot harder and start chasing new business.

If there’s no deep-seated, intrinsic “burning desire” to motivate an advisor to keep pushing past their point of comfort, then no amount of extrinsic motivation will do the trick.

I remember money manager Mario Gabelli said one time that his firm only hires people who are PHDs—as in “Poor, Hungry, Driven.”

There is much truth to that because it’s the people who have something to prove that will continue to work hard long past any financial need to.

To that point, Peter Mallouk said to me, “We have hundreds of wealth managers and even when you stabilize for book size, there is very, very wide discrepancy on the growth of practices and where the referrals come from clients, which tells me, part of it is investments, part of it is the brand, and part of it is the planning but a big, big, big part of it is the advisor.”

Yes, you can give an advisor all the tools and resources to grow, but if they are comfortable, few will avail themselves of the opportunity.

Examine your life. If you’re continuing to work hard long after you’ve reached a level of comfort, what is it that is driving you? No doubt there are a mix of things.

The Downside of AUM Pricing

How is it that so many advisors today have reached a level of comfort? I can trace it all back to the AUM pricing model.

When I started in the industry in 1993, it was a commission-driven business where you woke up every morning unemployed until you made your next sale. That system flushed out more than 90% of the people who started and those that remained—many of them are the leaders of today’s largest RIAs—are the ones who knew how to sell.

Once we shifted to the recurring revenue model of charging a fee for assets under management, our industry became extremely profitable and allowed advisors to shift from selling to servicing.

The new formula for success became—work hard for 10 years, get to $100 million in AUM, then shift to deepening client relationships, servicing, and let rising markets over time give you a raise.

That formula is hard to resist.

We are getting to the tail end now of the generation of advisors who grew up in the commission world and then shifted to the AUM model. These advisors are now transitioning their recurring revenue businesses to the next generations, G2 and G3, who are stepping into a cash cow.

Having never been tested by the fire of “eat what you kill,” many G2 and G3 advisors tend to be drawn toward the AUM recurring revenue model because it supports their desired work-life balance lifestyle.

These NexGen advisors grew up in an entirely different era—economically, culturally, and technologically—from boomers. Generally speaking, they value family, personal time, and pursuing passion projects over working 60 hours a week to build the next behemoth. And to be clear, I’m not judging their values or suggesting they need to be more like boomers—far from it.

What This Means

So where does that leave the industry and growth-minded advisory firm leaders?

- I think it’s showing up in the anemic rate of organic growth in the industry (see here and here). The recurring revenue model makes it easier to reach a level of comfort, to hover there, and to stay there longer.

- The lack of organic growth, coupled with advisors hitting the limit of their comfort zone, is a major—and usually unspoken—reason why we are seeing so much M&A.

- I continue to see advisors reach a certain level in their practice and then start selling “services” to other advisors. It seems like many advisors like hanging out with other advisors as much as, or more than, with their clients. Nothing wrong with that. It just means fewer advisors focusing on growing their advisory practices.

- The plethora of technology, the wide acceptance of virtual advising, and the support ecosystem in place means it’s easier than ever for an advisor to build a cool website and open for business on their own. And if you can make a few hundred grand a year, live where you want, and call your own shots, again, that’s hard to resist.

- Leaders of advisory firms must accept that while most advisors have a “growth mindset,” that growth has a limit. If you find that your associate advisors are spending more time fiddling with portfolios, tweaking financial plans, and demoing the newest technology than they are prospecting for new business, you’ll know they’ve reached their comfort level.