Strategic, tactical, and personal financial advisor coaching.

Coaching Financial Advisors To Get Better, Not Just Bigger

Steve Sanduski, CFP® has worked with more than 1,000 financial advisors over the past 30 years. Today, he coaches a select number of financial advisors who want to master their craft.

–

RECENT FINANCIAL ADVISOR COACHING CLIENTS

–

–

Steve Sanduski, CFP®, Financial Advisor Coach

Financial advisor coaching gets results

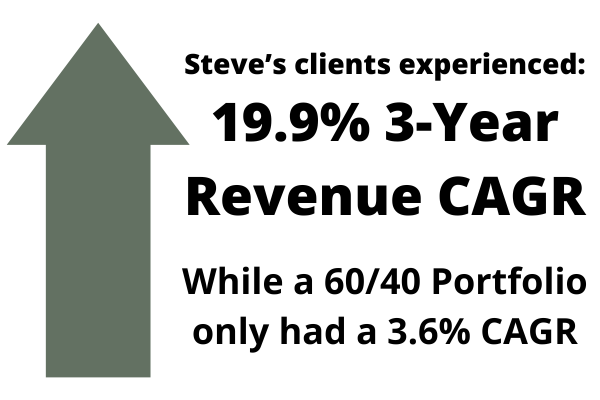

Working with Steve is an investment with a high ROI. From 2021 through 2023, Steve’s clients experienced a 19.9% revenue CAGR, which is 5.5X the growth of a 60/40 portfolio.

–

–

–

–

–

–

–

Experienced coach who wrote the book on coaching

–

Steve co-created what is now Carson Group Coaching back in 2001 and co-wrote, Tested in the Trenches, one of the top practice management books. His coaching includes:

-

Business strategy, clarity and corporate identity

-

Personal drive and motivation

-

Building out the executive leadership team

-

Hiring, compensation, and people strategy

-

Building out the product and service offering

-

Client experience

-

Operational systems

-

Growth marketing

-

Tech stack

-

Succession planning, business protection

-

Financials and metrics

-

World-class execution to get results

We co-create your ideal business–not some cookie-cutter version–so you and your clients can live your best life.

–

Dennis Morton, CFP®, CHFC® and Kathryn Brown, CFP®, CHFC®

“We credit Steve with helping us to double the size of our firm in three years.”

–

“Shortly after founding Morton Brown Family Wealth, my partner, Katie Brown, and I recognized the need to have another voice at the table to help us think strategically and build our firm to its potential.

Since that time, Steve Sanduski has been our coach and has brought insights, perspective, and accountability to all aspects of our advisory business and our leadership.

We credit Steve with helping us to double the size of our firm in three years, attract a talented staff, and strengthen our culture for the benefit of our clients.”

–

–

–

“Does your desire match your dream?”

Steve was a guest on Mindy Diamond’s podcast and they discussed his story as well as some of the concepts he teaches including 5 tips on how to get from $500 million in AUM to $5 billion.

Quotes from Steve:

I firmly believe that every advisor can grow to whatever level they want and the only thing that holds them back is does their desire match their dream. If you fall short of your goals, it’s not because you lack knowledge—you can google it or pay for it. It’s not because you lack the technology—you can subscribe to it. It’s not because you lack money—you can bootstrap your way to your first million. It’s not because you live in a small town—you can use technology to work nationally. I could go on and on with excuses. I’ve worked with enough high achievers over the past 30 years to know that the only limiting factor to what you can achieve is the degree of your desire. People who achieve at the highest level simply want it more.

Every firm that has grown from $500m to $5b has taken a different path, there’s no one way that is guaranteed to get you there. If all you do is mimic other people, you will end up as a second-rate copy of someone else instead of a first-class version of you.

Forget this idea of trying to hire people that fit your culture, instead, hire people who will further your culture. If you’re just looking for cultural fit, then you’ll end up with a lot of people who look and act just like you and that’s not going to help you, your clients, or society in general.

Before we get to strategy and execution plans, it helps to know your approach to business and life success. The idea here is to do some serious self-examination and understand what is your driving force that animates how you “do” and “think” about business and life. It’s not “mission and vision statements,” rather, it’s an overarching philosophy that encompasses what you’ve come to believe over your lifetime of experiences.

5 Keys to Growing to $5 Billion in AUM

Mindy Diamond interviews Steve Sanduski

–

Greg Munroe, CFP® and Matt Morrow

“Steve’s coaching has completely exceeded our expectations.”

–

“He is a true expert in understanding the needs of a fast growing wealth management business.

We have realized that hiring Steve was the most important investment we have made to truly focus and energize our business.”

–

–

Financial Advisor Coaching starts with CLARITY

Get clear on what you want.

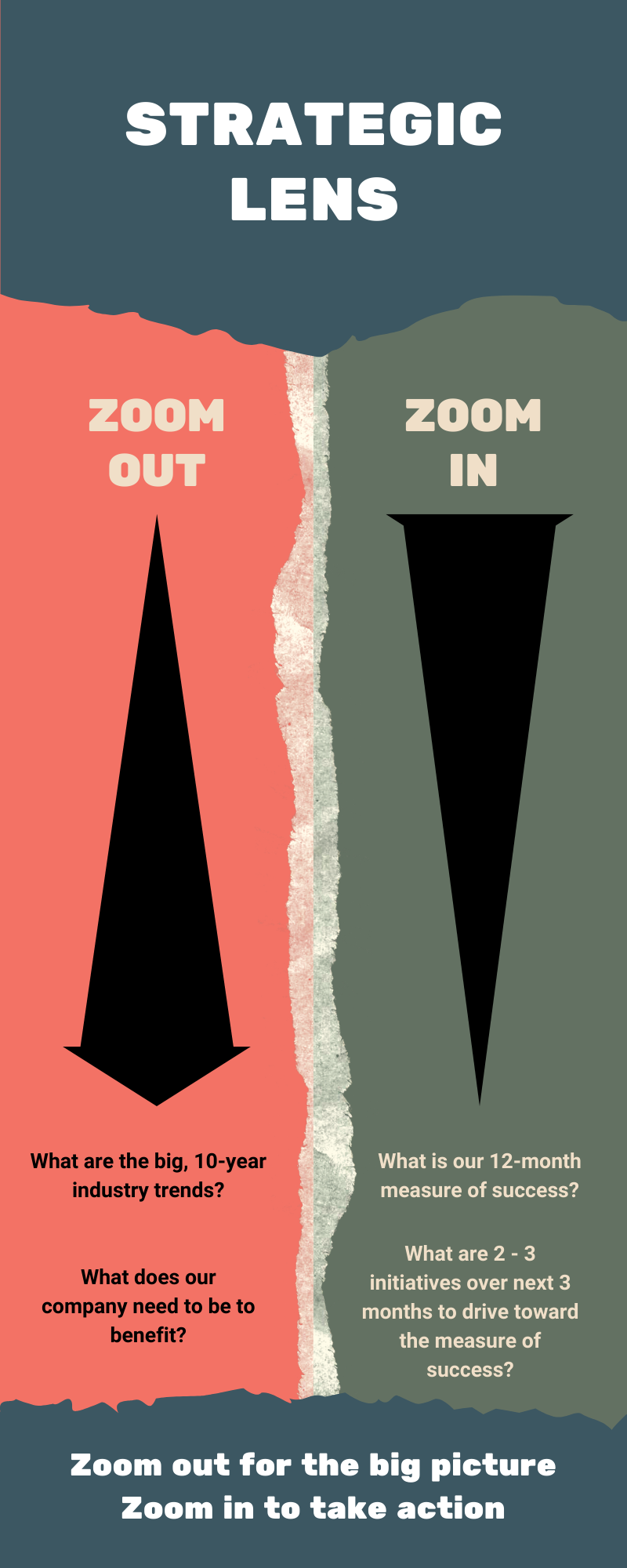

Through our deep discovery process, we zoom out to get your direction right, then zoom in on what we need to do in the next 3 – 12 months to keep dialing in on that direction. This might include:

-

Identifying and executing on an aggressive growth strategy

-

Adding or accelerating the pace of a mergers and acquisitions strategy

-

Assessing and improving internal culture and operations to drive growth and profitability

-

Building out the executive leadership team

-

Hiring advisors and other key team members

-

Developing career paths and comp plans

-

Fine-tuning the business to increase valuation

-

Reviewing options to go independent

-

Systematically reviewing every aspect of the business to make it world-class

–

Bill Keen, CRPC®

“Steve has a mastery of the key issues that drive delivering best in class client service and healthy growth.”

–

“He encouraged me to start my podcast many years ago and has been my co-host and producer on over 150 episodes.

In addition, Steve has consulted with our firm as we have gone through our various stages of growth.

I deeply respect his wisdom and perspective and would recommend him to anyone looking to start, build, and grow a financial services firm.”

–

–

–

Effective CEO Leadership Drives Company Growth

Coaching helps make better leaders.

Hard work can get you to several million dollars in revenue.

Great leadership will get you to $10 million or more in revenue.

Great leaders fit the following profile:

-

Guiding philosophy. This is your framework for living. It’s a way to define yourself, your conduct, your decision-making, your way of being, and how you show up in the world. It’s your unique combination of thoughts, beliefs, values, instincts, actions, purpose, and experiences that shape how you go about living your daily life. It underpins and drives what, when, why, and how you do what you do. Great leaders define and refine their guiding philosophy.

-

Action learner. If you’re not learning faster than the world is changing, you’ll fall behind at an accelerating rate. Great leaders are continuous learners and they put their learning into action.

-

Execution plan. The top firms implement a consistent meeting rhythm that includes annual, quarterly, monthly and weekly meetings, each with a specific purpose and tied to accountable outcomes. Great leaders ensure plans are set and goals are met.

Our financial advisor coaching works with you to develop your leadership profile so you can lead your company to greater impact.

Brent Shimman

“Working with Steve has been of tremendous benefit to our firm.”

–

“Steve has been able to help us on many fronts–operating standards, culture, profitability metrics, amongst many others.

He has helped us refine our goals and then holding us accountable to achieve and exceed those goals.

There hasn’t been a session where we didn’t gain knowledge and greater insight into the direction we are taking our firm.”

–

–

$3M to $10M in Revenue is a Tricky Spot

If you’ve built a multimillion-dollar revenue business like I have, you may have noticed a pattern called “The Rule of 3 and 10.” It’s the idea that things break in a business at roughly every 3x and 10x in growth.

For example, at $350,000 in revenue, it’s just you and it’s simple.

At $1 million in revenue, you need a couple employees, and it gets a little complicated.

At $3 million, you need a new tech stack.

At $10 million, you need an executive leadership team, and so on.

This $3 million to $10 million revenue range is a very tricky spot. Why? Because you have two competing tensions.

This $3 million to $10 million revenue range is a very tricky spot. Why? Because you have two competing tensions.

-

You’re likely pulling down a million or more in personal income so that’s quite comfortable and tempting you to “hang out.”

-

You’re at a major inflection point and must decide if you want to turn your business into a company that has salable value and can run without you.

Financial advisor coaching helps you identify and evaluate the options, choose a course of action, then relentlessly execute.

How Financial Advisor Coaching Works

Every advisor is different and you need a coach who is best suited for your specific situation. That’s why we offer two options and depending on the complexity of your situation, you’ll work with either Steve Sanduski or his longtime colleague and coach, Amy Koenig.

Coaching Details

-

2 coaching calls per month for 90 minutes each. In the early stage, we’ll get extremely clear on exactly what you are trying to accomplish, determine the specific steps necessary to make it happen, and create the scorecard to measure results.

-

Prior to each call, we’ll publish an agenda to our private cloud-based project management site. Of course, we’ll start with what’s top of mind on your agenda first.

-

During each call, we’ll work on your specific objectives and drive toward accomplishing them.

-

After each call, we’ll post our detailed notes of the call, along with the action items, to the project management site.

-

Throughout our coaching relationship, you’ll have access to our network, our tools, and you’ll have reasonable email access to your coach in between calls as needed.

Steve and Amy collaborate on coaching cases so you get the best of both coaches.

Ultimately, our role is to help you get your desired results much faster than you would without our help.

Are We a Good Fit?

Steve’s high-performing financial advisor coaching is best suited to owner/advisors and CEOs with firms generating north of $3 million in revenue while Amy generally works with advisors and CEOs below $3 million in revenue.

Coaching is month-to-month with no minimum contract so you’ll never feel locked in.

The price is either $2,200 or $3,200 per month for up to two partners together, depending on the complexity of your situation.

–

The Next Step is to Take Our Business Assessment

To be considered for coaching, please complete our free Business Assessment–should take about 10 minutes. Once you complete this assessment, we’ll schedule a complimentary call to discuss your situation, your assessment results, and coaching details. Based on this call, here’s what happens next.

-

If there is a fit, we schedule the first coaching call.

-

If there’s not a fit, we part as friends.