The acute phase of the Covid-19 pandemic and market collapse may (hopefully) be over, but the need to be visible and vocal, to communicate effectively, remains.

The medical, economic, social, and political ramifications of the pandemic have only just begun. Just like we never completely healed from the Global Financial Crisis (GFC), except for asset price inflation, the pandemic fallout will likely be vast, painful, and sustained. As a result, your communication plan should remain at an elevated level for the foreseeable future.

A key, underlying component of your communication plan should be your “point of view.”

A point of view is the angle, the filter, through which you view things and the resulting opinion and beliefs that come from that positioning.

During a crisis, people want answers. Unfortunately, uncertainty is at its peak during a crisis and our ability to have “answers” is at its low. However, the best leaders during times of uncertainty assess the situation, seek expertise, and connect the dots to create an informed point of view and then they share it widely.

In the US, fiscal and monetary policy have rescued the financial markets (at least temporarily), and many advisors are breathing easier. But just look outside and you can see the lack of economic activity and the fomenting anger. Free money is treating the symptom, but it is not a vaccine that prevents the underlying condition.

As of just two months ago, we had all-time highs in the stock market and record low unemployment here in the US. On the surface, things looked pretty good.

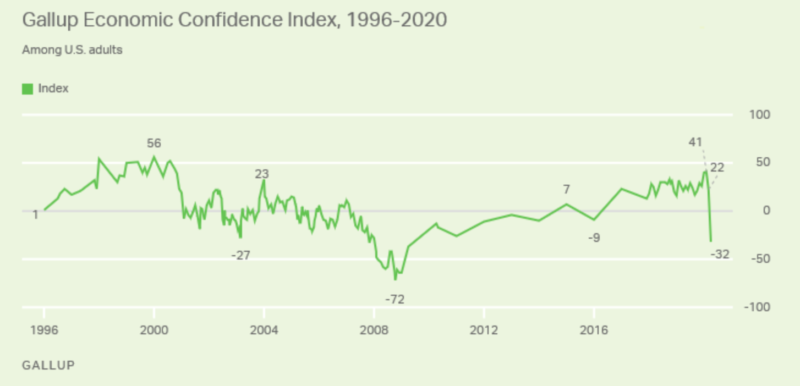

But the pandemic pointed out just how fragile that environment was. This economic confidence survey from Gallup shows how quickly things changed.

The current extreme environment offers you two “bookend” points of view to frame the current environment. Look at these and think about which one immediately makes sense to you.

- The economy and financial markets will recover just like they always have, and fiscal and monetary policy will always be there to backstop any big issues that may arise.

- This is unchartered territory and I better pay close attention to what’s happening as things may not unfold as neat and tidy as they have in the past.

Yes, there are gradations between the bookends and some overlap, but basically, you either believe the government will always be the backstop and things will be fine once we open the economy again or you think things have permanently changed in unpredictable ways.

To be clear, I’m not here to convince you of which point of view you should have. But I do want to convince you to HAVE a point of view, to be thoughtful in how you develop that view, and to be visible and vocal in sharing it.

6 Questions to Form Your Point of View

To help you form your point of view, here are six questions that you should have deep, thoughtful, strong answers to. Three of these relate to common questions you may hear from clients, while the other three revolve around your view of the future. Most of your communication going forward should be variations on these themes.

To continue reading, please enter your email address to unlock the content.

Questions Clients Ask You

1. Am I still ok?

Whenever there’s a significant drop in the markets, many clients want to know if their financial plan is still on track. Of course, this is job one for you and it starts from day one of working with your clients.

From the beginning, it’s about setting appropriate expectations, setting aside liquid assets so you’re not forced into selling at an inopportune time, and developing an investment plan to support their financial plan. You know what to do here and should be able to answer this question relatively easily.

2. What should I do now?

This one gets a little bit harder and will depend on how you answer questions 3, 5, and 6 below. During the current crisis, many advisors rebalanced portfolios, did tax-loss harvesting, and repositioned portfolios to take advantage of “bargains.” Some advisors made no changes and just reinforced to their clients that drops like this were expected, planned for in advance, and are within the bounds of past experience. Either way, you should have a strong response to the question and be able to back it up with thoughtful analysis.

3. When do you think things will get back to normal and the markets will settle down?

They’re asking us to predict the future which we obviously can’t. But we need to have a point of view on this in terms of what do we think needs to happen and in what order before we can even hope to have things get back to some semblance of normality.

Peter Mallouk of Creative Planning has done a great job of consistently promoting his point of view across various media outlets including Forbes, Worth, Yahoo!, Bloomberg, Fox and Twitter. For example, here’s his “point of view” that he wrote in Worth on March 31 about when and how things will “get back to normal.”

“As soon as investors see some sign of progress, the markets will change. We don’t need to have a cure or vaccine, just some signal that the spread is under control and that we’re ‘flattening the curve.’ What we have now is really two crises—one health care, one financial. Once we have the health care aspect under control, the markets will rebound. If the health care crisis ends in four to eight weeks, the recovery will look like a V shape, where everything goes down and then quickly goes back up once people are back to work. If it takes three to four months, it will look more like a U shape; and if it ends up being a worst-case scenario, we’re looking at an L-shaped recovery.”

In that single paragraph he answered:

- What will cause the markets to turn back up.

- The timing of the upturn.

- The three potential shapes and timing of the economic recovery.

- The reasons for the three different shapes of the recovery.

With that clarity, is it any surprise that he’s running an RIA with tens of billions of dollars in AUM and is frequently quoted in the media?

Now, Peter could be wrong. Maybe we end up with a W shape, or a V followed by a L, or some new letter that hasn’t been invented yet. The point is not whether Peter will be right or wrong. The point is he has a point of view, that view shapes how he manages his clients’ expectations and their portfolios, and I’m confident that as new information arrives, he’ll adjust his point of view if needed.

Questions You Ask Yourself

4. What is the proper role of fiscal and monetary policy in our economy?

What I find interesting about this question is that crises reveal an important truth. And the truth is, many people are capitalists when things are going great, and socialists when mayhem breaks out. Look no further than the hedge fund managers or corporate titans who happily rake in millions in good times, then are first in line to get the “first come, first served” Paycheck Protection Program money when things crash.

Clearly, government intervention in the economy and financial markets has been going on forever and few people would argue about the need for some intervention during crucial times. The question is, what degree of intervention do you think is appropriate?

Recently, the Fed started buying junk bond ETFs to increase liquidity in that market and prevent a meltdown. Some industry pros were appalled by that move as it signaled deeper encroachment by government in what has historically been a role of capitalism. Buying equity ETFs could be next if there’s another big downdraft in the equity markets. Are you ok with that? How you answer that question helps inform your point of view.

Japan is already way ahead of the US in this regard. The Bank of Japan started buying equity ETFs about a decade ago to prop up its equity market and now owns more than $270 billion worth of the corporate pie. Interestingly, Japan’s Nikkei 225 stock index is still 50% below its all-time high set more than 30 years ago! Do you think the US is on a similar path? Again, this informs your point of view.

5. What are the longer-term medical, economic, social, and political ramifications of the pandemic and the fiscal and monetary policy that resulted from it?

This is a biggie. I’ve been alluding to this question in recent GTKs because I think it’s critically important that you stay alert to what’s happening. Keep your eyes and ears open to the events and happenings that bubble up across the country and around the world. Take time to connect the dots and develop a framework for putting them in context. Read periodicals that you haven’t read before. Subscribe to email letters like GZERO Media’s Signal and The Conversation’s Daily. If you watch Fox News, switch to CNN sometimes, and vice versa. Digest a variety of inputs so you don’t end up with confirmation bias.

Here’s an example of how Ian Bremmer is connecting some dots and coming up with a hypothesis that corporations may become more profitable in the future at the expense of fewer employees—and that may lead to lower consumer spending.

“With businesses under stress across the economy, they need to improve efficiency. And they will—most every CEO I know has been telling me how they’ll be able to make more money with fewer people over the coming decade. They’re now being pushed to figure out those cost savings immediately, all at once.

“As one Fortune 100 CEO said last week: ‘I guarantee that our company, like many others, will operate with fewer people, smaller buildings, and far more efficient ways of doing business.’ So, the fourth industrial revolution is about to become the post-industrial revolution for large numbers of former workers; medium term, that feels to me like a minimum of 10% of the economy. Consumption across the board will be hit accordingly.”

You can do what Bremmer does: Gather input, connect the dots, then develop your point of view.

I have a neon sign in my office that says, “Everything is Connected.” I think that’s very apropos in the situation that we’re going through right now. This virus started in the middle of China with one person and has now spread worldwide. Think about that, in this day and age, just how globally connected this world is that something can start with one person in the middle of China, spread around the world, and basically throw the whole world into a global recession—all within just a few months. It’s all connected.

None of us know what will happen but as professionals it’s our job to assess the environment, to limit blind spots, to think about the scenarios that our clients don’t have the time or insight to formulate, and to create a coherent point of view and game plan that makes sense based on the available information. And that point of view and game plan should evolve over time as new information arrives.

6. What should I being doing differently going forward to ensure my business thrives no matter what the new normal looks like?

As humans, we’re adaptable creatures. We can take massive punches yet still find a way to recover and thrive. And I have no doubt we’ll do the same in this crisis. In fact, crises are often the catalyst for bringing out the resourcefulness of the human spirit.

Knowing that, how will you evolve as an advisor and as a business owner? Will you change your investment philosophy and add additional asset classes? Will you change your pricing or enhance your service offering? Will you sell to a larger firm to give you long-term stability and greater resources? The possibilities to evolve are endless.

One thing I do know is, if you continue business as usual, you’ll quickly get left in the dust by forward-thinking advisors who are aggressively adapting as the world changes.

Communicate

Advisors ask me all the time, “How do I get more clients?” One of the best ways is to have a point of view on issues important to clients and share it widely, consistently, and with memorable clarity to your targeted audience.

Now is the time to be visible and vocal to your targeted ideal client audience. Not in a tone-deaf salesy way but in a helpful, educational way. Do webinars. Send out email letters. Write and promote your blog posts. Write guest post for other websites. Get active on LinkedIn and Facebook. Publish videos and podcasts. Reach out and connect with journalists on Twitter and LinkedIn.

You can use your answers to questions 2 – 6 to generate all kinds of content ideas in your “visible and vocal” communication campaign. Create the content once and repurpose it for the other media channels.

The opportunity to grow and distinguish yourself right now is tremendous. People are cracked open and willing to consider something new. With your well-formulated point of view, you can fill that void and gain a disproportionate share of new business.

Resources

– Values Clarification Toolkit Click here to download this FREE tool and start living your values.