What separates an average CEO from an excellent CEO? How do you achieve CEO Excellence?

Turns out it’s all in your head. Well, that’s simplifying it just a bit.

CEO Excellence Podcast

In an important new book titled, CEO Excellence, three senior partners at McKinsey & Company—Scott Keller, Vik Malhotra, and Carolyn Dewar—drew two important conclusions.

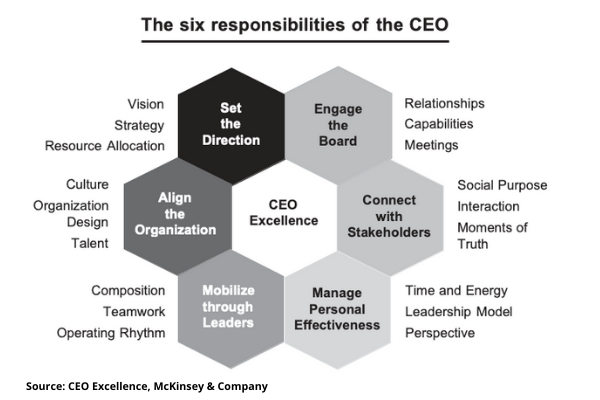

- The CEO role can be reduced to six critical responsibilities and 18 associated practices.

Not surprisingly, each of those six responsibilities and 18 practices have an endless number of “things you can do” within those responsibilities and “a thousand different behaviors” that help drive results.

Unfortunately, writing a book about “endless things” and “a thousand different behaviors” would not be helpful to aspiring or existing CEOs. The real breakthrough in this book came from their second key conclusion.

- What separates the excellent CEOs from the average CEOs is the MINDSET that the excellent CEOs bring to bear on the six key responsibilities.

Specifically, the authors identified a key mindset that was associated with each of the six responsibilities.

| Key CEO Responsibility | Associated Mindset |

| 1. Set the Direction | Be Bold |

| 2. Align the Organization | Treat the Soft Stuff as the Hard Stuff |

| 3. Mobilize Through Leaders | Solve for the Team’s Psychology |

| 4. Engage the Board | Help Directors Help the Business |

| 5. Connect with Stakeholders | Start with “Why?” |

| 6. Manage Personal Effectiveness | Do What Only You Can Do |

What is Mindset?

As Scott Keller said to me, “Mindset is sort of a set of beliefs or assumptions that color one’s perception and predispose them to behave in a certain manner. What that means is from a certain mindset, stems many behaviors.”

I want to share a couple examples here of the first mindset—be bold—to illustrate how you turn a mindset into specific action and create CEO Excellence.

But first, let me share a statistic that should make you sit up a little straighter in your chair.

According to McKinsey & Company research as published in the book, “only 10 percent of companies create 90 percent of the total economic profit (profit after subtracting the cost of capital) and the top quintile performers deliver thirty times more economic profit than the companies in the next three quintiles combined.”

In other words, almost all the economic profit created by the world’s largest companies accrues to just the best-performing 10 percent.

But wait, there’s more. Within that top 10 percent, just the top 2 percent together earn about as much as the next 8 percent combined. And the bottom 20 percent of companies “suffer deep economic losses.”

While we don’t have similar data for the financial advisory business, we have some metrics around advisory firm growth that indicate the best performing firms are grabbing the lion’s share of new business.

In the 2021 RIA Benchmarking Study from Schwab, the top performing firms (defined as firms that rank in the top 20% of Schwab’s proprietary Firm Performance Index), grew their 5-year net organic assets at 3.0x the rate of the bottom 80% of firms. In addition, these top performing firms grew revenue at 2.1x the rate of the other 80%.

It’s no stretch to say that one key to the fast growth of these top performing advisory firms is they have a bold mindset. They take the view that “fortune favors the bold.” As the authors wrote in CEO Excellence, leaders with a bold mindset are, “less a ‘taker’ of their fate and more a ‘shaper’;— constantly looking for and acting on opportunities that bend the curve of history.”

Netflix Example

Let’s use the first key responsibility, “set the direction,” as an example of how mindset comes into play. As shown above, one of the elements of set the direction is vision. Now, the mindset that you bring to the task of setting the vision has a huge impact on how bold your vision ultimately is.

Reid Hastings cofounded Netflix in 1997. He could have had a vision to be the number one DVD company in America and that would have made perfect sense from a 1997 point of view. But no. From the very outset, Hastings had a bold vision much bigger than just the DVD market.

In a Wired.com interview way back in 2002, Hastings said, “The dream twenty years from now is to have a global entertainment distribution company that provides a unique channel for film producers and studios.” And in talking to the CEO Excellence book authors he added, “That’s why we called the company ‘Netflix’ and not ‘DVD BY MAIL.’”

Further, the authors wrote, “With his more expansive vision, however, the big strategic moves that followed made sense in ways they would never have otherwise: moving into video streaming, betting on the cloud, creating Netflix Originals, driving exponential globalization, and so on.”

Hasting’s bold vision is one key reason why we’re talking about Netflix today and not Blockbuster Video.

Two RIA CEO Examples

Let’s say we have two RIA CEOs and each of their firms have $10 million in revenue. As they gather round for their annual planning meeting, they are mulling over a new vision for the firm.

1. The first CEO, let’s call him Luke, has an unspoken, but deeply held mindset of, “let’s not lose what we’ve achieved so far.” As he rallies his executive team around a new vision, he says, “Let’s target $25 million in revenue five years from now.” Luke’s reasoning is that it’s still a hefty 2.5x multiple of today’s revenue and a growth rate of 20 percent annualized. The reality is, that’s pretty standard stuff and his firm won’t have to make any bold moves to make that happen. He’s consolidating gains rather than embracing opportunities.

2. By contrast, the second CEO, let’s call her Monique, has a bold vision for the future of her company. She doesn’t view her company as being in the financial advisory business. She says to her team, “We’re in the contribution business. We’re experts in financial matters and our contribution is to help our clients make smarter financial decisions so they can support their families and have money left over to help those who are less fortunate. Look, we have 1,000 families that we’re helping today with an average of $1,000,000 in household assets. Let’s aspire to help 10,000 families with an average of $1,000,000 in household assets. And in terms of contribution, let’s create a new metric called “Assets Contributed” and set a target of helping our clients give away $100 million to charitable organizations. And I think we can do this in seven years. And for our part, let’s give each team member an additional 16 hours per year of paid time-off, designate those hours as “Contribution Hours,” and encourage our team members to use those hours to give back to the community.”

Can you see the difference in mindsets here? Which CEO will end up with the most engaged team?

The actions and behaviors that will flow through the organization from Monique’s mindset will be very different than in Luke’s organization. Why? Two reasons.

1. Luke’s company can grow 20 percent annualized just by getting better at what they’re currently doing and trying a handful of new marketing initiatives. It’s incremental. Not so for Monique.

Her firm can’t “incrementally” grow 39 percent annualized for seven years by just working harder and smarter. Her team has to throw out the current playbook and develop new strategies that create the possibility of achieving a 39 percent growth rate and helping 10,000 families. For example, she might have to seek outside capital and implement an inorganic growth plan.

2. Monique’s framing of 10xing the number of families they help and facilitating their clients giving away $100 million over seven years is much more purpose-driven than Luke’s “let’s target $25 million in revenue five years from now.” Few people, other than the firm’s owners, get excited about purely financial metrics. Monique’s vision will create energy and momentum on the team that by itself will generate discretionary effort and incremental growth.

Six Spinning Plates

One thing that makes the CEO role so difficult is you are no longer a specialist. Instead of being great at a functional aspect of the business, like business development, or being a wonderful relationship builder when meeting with and advising clients, you must meaningfully tend to all six responsibilities and keep all six plates spinning at all times.

Essentially, you have to move from being a “doer” to being a “do througher.” It’s like moving from first violinist to being the orchestra conductor. Your results no longer come from what you personally do, rather, they come from how you facilitate, orchestrate, and inspire results through others.

When advisors reach a certain size in their business, the need for dedicated “professional” management to keep these six plates spinning arises. I often see this around the $7 – 10 million in revenue mark. And this level is typically a key inflection point for the business where advisors are faced with three options.

Option 1: The founder consciously reduces the number of clients they directly lead so they can devote substantial time to managing the business.

Option 2: The founder realizes they are either ill-equipped or not interested in assuming a greater management role in the firm, so they hire or promote someone from within to take on the main leadership role.

Option 3: You realize it’s time to cash out and you sell or merge your firm and let the new owner/partner takeover leadership.

Not for Everybody

In my 29 years of experience leading companies and coaching advisors, it’s clear that very few people are wired to succeed in the CEO role. You can’t “part-time it” and expect to be successful. Even the most successful CEOs, whether in the financial advisory space or corporate America, all struggled at various points in their time in the C-suite.

I just shared one of the six mindsets related to the six key responsibilities. Imagine multiplying that by five and knowing you have to do all six well in order to succeed at the highest level.

If you truly want to be an outstanding CEO, you have to be dedicated to continuous learning, to curiosity, and embrace the mindsets outlined in CEO Excellence.

This is the first in a series of articles on what it takes to reach CEO Excellence. Make sure you subscribe to my newsletter, GTK, to get the future articles.

My Key Takeaways from CEO Excellence:

- Six roles and mindsets. Every CEO does similar things in their role. What separates the good from the GOATs is the mindset you bring to bear on the six roles.

- From Doer to Do-Througher. The CEO role is about leverage. It’s about your ability to orchestrate results through a high-functioning team that cascades throughout the organization and to outside stakeholders.

- Not for everybody. Very few people have the drive, the multitude of skills, and the personal effectiveness necessary to excel as a CEO. But this book is a great place to start on your journey to CEO Excellence.

Complementary Podcast:

Jon Jones, CEO of multi-billion dollar RIA firm Brighton Jones, talked with me about how he systematically designed the firm so he could spend one year away traveling the world with his family while his kids were still young. During that year, they visited 35 countries and when he returned, the firm had grown substantially.

Jon said, “I created a framework to say, ‘I’m not going to leave our business until I know we have at least one person that I’ve hired that is just thinking about the strategy around getting people, keeping people, getting clients and keeping clients.’ As long as I had a really solid COO who was overseeing all of operations, I felt fine about taking off for a year. But from the strategic standpoint, I felt like having somebody in charge of ‘get keep’ was super important, and still is.” Listen/read here.

Resources Featured In This Episode:

CEO Excellence: The Six Mindsets That Distinguish the Best Leaders From the Rest by Carolyn Dewar, Scott Keller, Vik Malhotra