Your business may not be for sale, but it should always be salable.

According to a 2019 study by J.D. Power, the average age of a financial advisor is 55; approximately one-fifth of advisors are 65 and older. If you’re within 5 – 7 years of exiting the business, succession planning should be one of your key strategic initiatives. Paul Blease advises that preparing to sell your practice is a process of analysis and optimization that requires a multi-year runway. Without proper planning, you risk undervaluing your life’s work and damaging the key client relationships you’ll need to sustain the business when the time comes to retire.

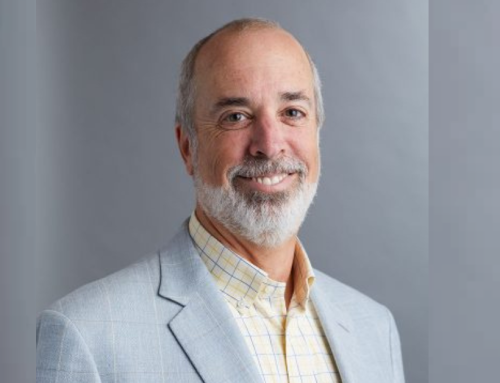

Guest: Paul Blease, Strategic Consultant, Invesco Global Consulting at Invesco Global Consulting. Click here for my conversation with Paul about building synergistic teams for your advisory firm.

.

Paul and I discuss:

- Why prospective buyers and sellers shouldn’t be relying on “industry standard” valuation metrics alone when considering an acquisition.

- Paul’s three-step process for evaluating a firm’s sustainability.

- How to communicate your succession plan to your most valued clients so that they don’t jump ship.

- The “four rooms” of your practice that advisors need to optimize before presenting to potential sellers.

- How buyers may analyze the tradeoffs between a firm that’s growing fast and a firm that’s growing slower but with higher profit margins.

- Promoting specialization as a means to attract synergistic buyers.

- The importance of determining the optimal number of manageable clients for your business.

- Why “outgrowing” your original clients is one mark of a successful advisory firm.

Resources:

Download Invesco’s Changing the Guard Toolkit: A Comprehensive Approach to Succession Planning.