Do you remember how you felt back in 2008 and early 2009? Do you remember how your clients felt? Do you remember telling yourself, ‘I never want to go through that again?’

I’ve been telling my coaching clients that it’s time to prepare yourself, your business, and your clients for the next 50% drop in the stock market.

Do a “bear market drill” now and be ready when the next bear strikes.

Don’t get me wrong, I’m not making a market timing call. I’m just stating facts. Even a cursory look at the long-term charts tells you the market tends to move in long cycles and we may be cresting near the top of the latest one.

To continue reading the rest of this post, please register below with your email address.

Long Cycles

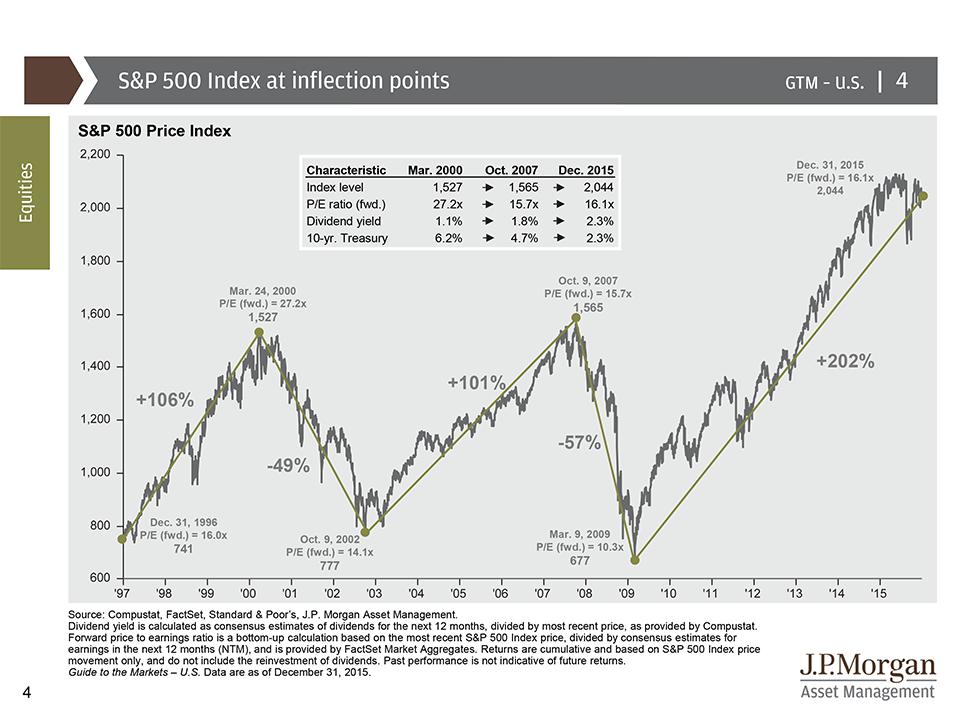

Let’s take a look at what has happened with the S&P 500 index in just the past couple decades.

- Between 1997 and 2000, it rose about 100%.

- Between 2000 and 2002, it dropped about 50%.

- Between 2002 and 2007, it rose about 100%.

- Between 2007 and 2009, it dropped about 57%.

- Between 2009 and 2015, it rose more than 200%.

Here in early 2016, the stock market has started the year looking pretty ugly. Is this the start of the next bear? Nobody knows.

I’m not a market forecaster but it doesn’t take a rocket scientist to figure out that the stock market is living on borrowed time. It’s quite plausible the next 50% move in the market will be down, not up.

Here’s my recommendation—do a “bear market drill” and review how your portfolios are positioned right now.

The stock market is going to drop 50% again, you know it, I know it, but none of us know when. But there is no better time than right now, while you can do it from a position of strength, to stress test your portfolios and see what would happen when we have the next 50% drop in the market.

I’m not telling you to move to cash. What I am saying is do some prudent scenario planning. How would your clients react when we have the next bear market? How would they react if that bear market happened in one day?

Yes, bear markets can happen in a day. It happened in October 1987. And today, even with circuit breakers in place, the market could drop 20% before trading stops for the day. Look at what’s happening in China right now.

Three Actions to Take Now

You don’t want to be making important investment decisions in the heat of the moment, when the market is crashing, so here are three things I think you should do right now to be better prepared for the next bear market.

1. Take a big picture look at your overall portfolios, assume the stock market drops 50% over the next 18 months, and ask yourself, ‘Are you comfortable with your current allocations?’

Stress test your portfolio and use software such as Hidden Levers or Riskalyze to do it. Are there some trigger points that would have to happen before you adjust your allocation? If so, make sure you know what they are. How would your clients react to a 50% drop? If you think some of them would panic, then talk to them now, continue to educate them about traditional market volatility, and consider making some portfolio adjustments to dial down the risk if appropriate.

2. Try to anticipate what would happen to your portfolios and your clients’ behavior if we had another flash crash or if we had a bear market in a day.

Another flash crash or bear market in a day would create massive headlines and scare the heck out of your clients. Are you prepared to handle the aftermath? How would you mobilize your team? Do you have a quick way to get a portfolio snapshot for your clients’ accounts to see how they performed?

3. Develop your communication plan so when bad times hit, you are completely prepared and ready to spring into action and support your clients.

When we have the next big market melt down, what and how will you communicate to your clients? Do you have a prioritized list of your top clients and a calling chain that says these are the clients you’re going to call and these are the clients that other people on your team are going to call? Are you going to send your clients an update letter? Will it go via email? Who’s going to write it? Are there triggers for when you’ll send out an update letter? Is there a threshold for who you’ll personally call versus sending them just a letter or email?

Over the years, I’ve talked to a number of financial advisors who were prepared for the 2008/09 meltdown and actually added clients during that tumultuous period. I’d like you to be one of them, too, when the next dark period arrives.

Be proactive, not reactive. Plan now for how you’ll handle the next bear market. Position you, your clients, and your business to not just survive the tough times, but come out stronger for it.

Resources

– Values Clarification Toolkit Click here to download this FREE tool and start living your values.