Historically, the financial advisory business has been about a story of numbers. Today, it’s about a number of stories, says Mitch Anthony.

Of course, the client-centered advisors always knew that this business was more than just numbers. And today, revolutions in technology and an aggressive marketplace make it imperative that all advisors change their thinking about what it means to be a financial advisor.

Pioneers in life-centered financial planning, like noted author and speaker Mitch Anthony, want to refocus our industry on a different story: the client’s.

How? By having better conversations that take place where money and life intersect.

Key Insights on Your Client’s Story from Mitch Anthony

“There are two ways to get to the meaning of life,” Mitch told me on a recent podcast. “One is to go out and experience something. The other is telling someone about that experience and sharing it with somebody else. That’s why stories are so important. I just found a huge vacuum in this industry when it came to story, and it’s such a gaping hole in the discovery process.”

“There are two ways to get to the meaning of life,” Mitch told me on a recent podcast. “One is to go out and experience something. The other is telling someone about that experience and sharing it with somebody else. That’s why stories are so important. I just found a huge vacuum in this industry when it came to story, and it’s such a gaping hole in the discovery process.”

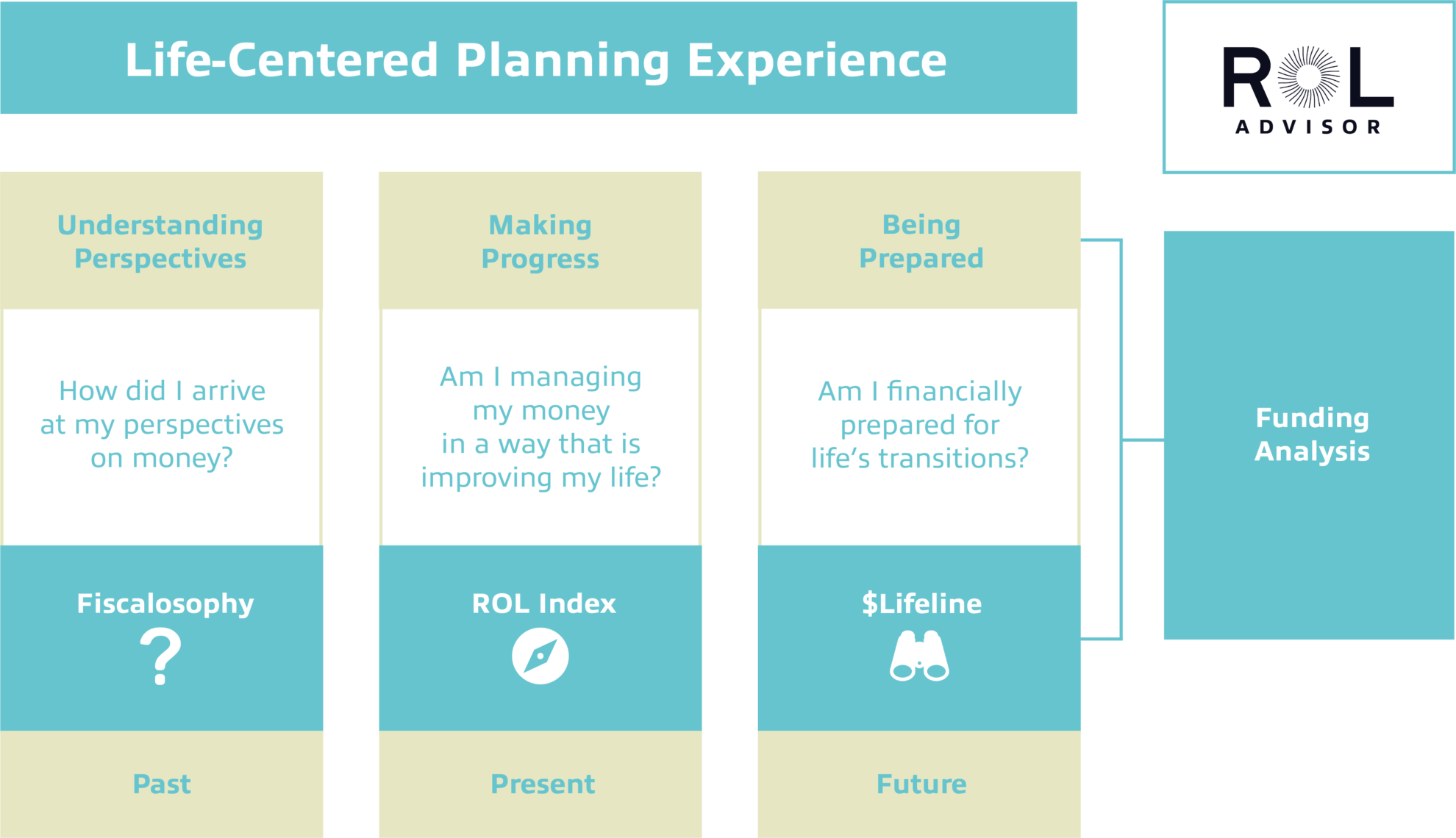

Mitch and I are partners in ROL Advisor, a company that’s trying to fill that hole and, in the process, transform the way the world plans. ROL stands for Return on Life, which should be the new focus for the advisor-client relationship as more and more of the old ROI activities are automated, and their value to clients depreciated.

Instead, ROL puts your client’s life and story at the center of the conversation, not their money. Advisors who master these concepts can use meaningful conversations to construct a three-panel storyboard that gives you a full picture of where your clients have been, where they are now, and where they’re headed.

The Past: How did you arrive at your perspectives on money?

“‘Where are you from?’ is the opener,” Mitch says. “And there’s no predicting where someone’s going after you ask that question. I’m going to hear about where you went to school, you might tell me about your first job, what your parents did, what life was like growing up. In that story, we advisors pick up cultural clues, socioeconomic clues, spiritual clues, political clues, experiential clues, familial clues.”

This conversation leads to what the ROL model calls the client’s “Fiscalosophy,” a scale that rates the client’s attitudes and comfort levels on key financial issues like debt, the stock market, and retirement.

But there’s a certain finesse that goes into not just grading how clients feel about their finances, but also understanding the root causes of those feelings. After all, money isn’t just numbers on a page. It’s personal, and our feelings about it are personal too.

Mitch tries to arrange his discovery questions in tiers. “Where are you from?” is a tier one question that allows the advisor and the client to open up to each other. Moving to a higher tier takes some tact and intuition.

“We shouldn’t be blindsiding people with questions,” Mitch says. “You need to set up a context first, and tell them, ‘I’m about to ask you a question that you may have never been asked before, because what you tell me from this question is going to be really helpful to build your financial plan.’”

An example of a higher tier question would be, “What was money like growing up?” This could lead the client to some emotional places: a parent losing a job, or even passing away unexpectedly, struggles to pay the bills, measuring what they had as a child against what their friends and neighbors had, moving from a larger house to a smaller one.

Hearing these stories will help you put together a more personalized plan that takes into consideration your client’s experiences and beliefs.

The Present: Are you using your money in ways that are improving your life?

As we move to the present, the discussions between you and your client really begin to deviate dramatically from the outdated metrics that our industry still obsesses over.

Mitch draws a clear distinction: “ROI basically says, ‘Get as much money as you can. Use your life to gather money, optimize your return. Then, hope the rest works itself out.’ ROL is saying, ‘No!’”

The point of working, saving, and investing is not to have more and more money. We should be helping our clients get the best life possible with the money they have.

Today, goals-based planning is trendy. But who wants to bottle up all their happiness and put it on a shelf for 20 or 30 years? Goal-setting is just another way of letting left-brained, numbers-based thinking rule the financial planning process. Clients are going to find much more value in an advisor who helps them use their money to enjoy life today, and in perpetuity on the way to a happy retirement.

That’s what our second tool, the ROL Index, helps clients measure: how their money affects their feelings of well-being, progress, and freedom right now. “The ROL Index is like running a blood test on your money,” Mitch says, “and showing you what levels are high, what levels are low.”

The results can be impactful. It’s one thing to know that you’re busy working hard every week. It’s another to talk to an advisor about a low freedom rating and realize that your pursuit of money is making it impossible for you – and probably, your family – to enjoy that money. This conversation could be the difference between a client grinding himself down to a nub before age 40, and a client changing his life for the better. And frankly, no computer will do that!

The Future: Are you financially prepared for life’s transitions?

Speaking of changes, that’s the focus of the third panel in our ROL storyboard, the future.

“The economic law of life is that money goes in motion when life goes in transition,” Mitch says. “Transitions are the cause and money in motion is the effect. You want to deal with the cause, not the effect. You want to be talking to people as soon as they’re aware of the transition coming so you can say, ‘Here are your options, let’s get a plan in place so we don’t get caught by surprise.’”

That’s why the ROL $Lifeline tool doesn’t include goals as it helps clients plot out the major transitions on the horizon. Maybe you take that dream vacation or build a second house, and maybe you don’t. But if your kids are headed to college, you may want to plan for and pay for some or all of that. If your company is on the skids, you’ll want to prepare for a potential job change.

Sure, there’s a place for goals in a financial conversation, just as there’s a place for numbers and nuts and bolts investment advice. But new era advisors have to put precedence on helping clients answer three big questions:

- What are your perspectives on key money issues and how did you arrive at them?

- Are you getting the best life possible with the money you have?

- Are you prepared for life’s big transitions?

If you use your humanness to help clients answer those questions, they will be your clients for life. And the better you get at asking these questions and filling in these storyboards, the bigger your business will grow.

Resources

– ROL Advisor Visit our new company and lean how to refocus your practice on you client’s story.

– How to Get Your Clients to Change Their Behavior–And Stick With It listen to my podcast with Sean Young

– How to Ask Better Questions to Uncover Your Client’s Values and Motivations and Drive Desired Behavior listen to my podcast with Elliott Berkman